Note: any and all opinions are entirely my own and do not necessarily reflect those of the Cleveland Fed, the FOMC, or any other person or entity within the Federal Reserve System. I am speaking exclusively for myself in this post (as well as in all other posts, comments, and other related materials). No content whatsoever should be seen to represent the views of the Federal Reserve System.

I had to take a quick detour from writing two future posts to briefly add to the “it’s all used cars” discourse.

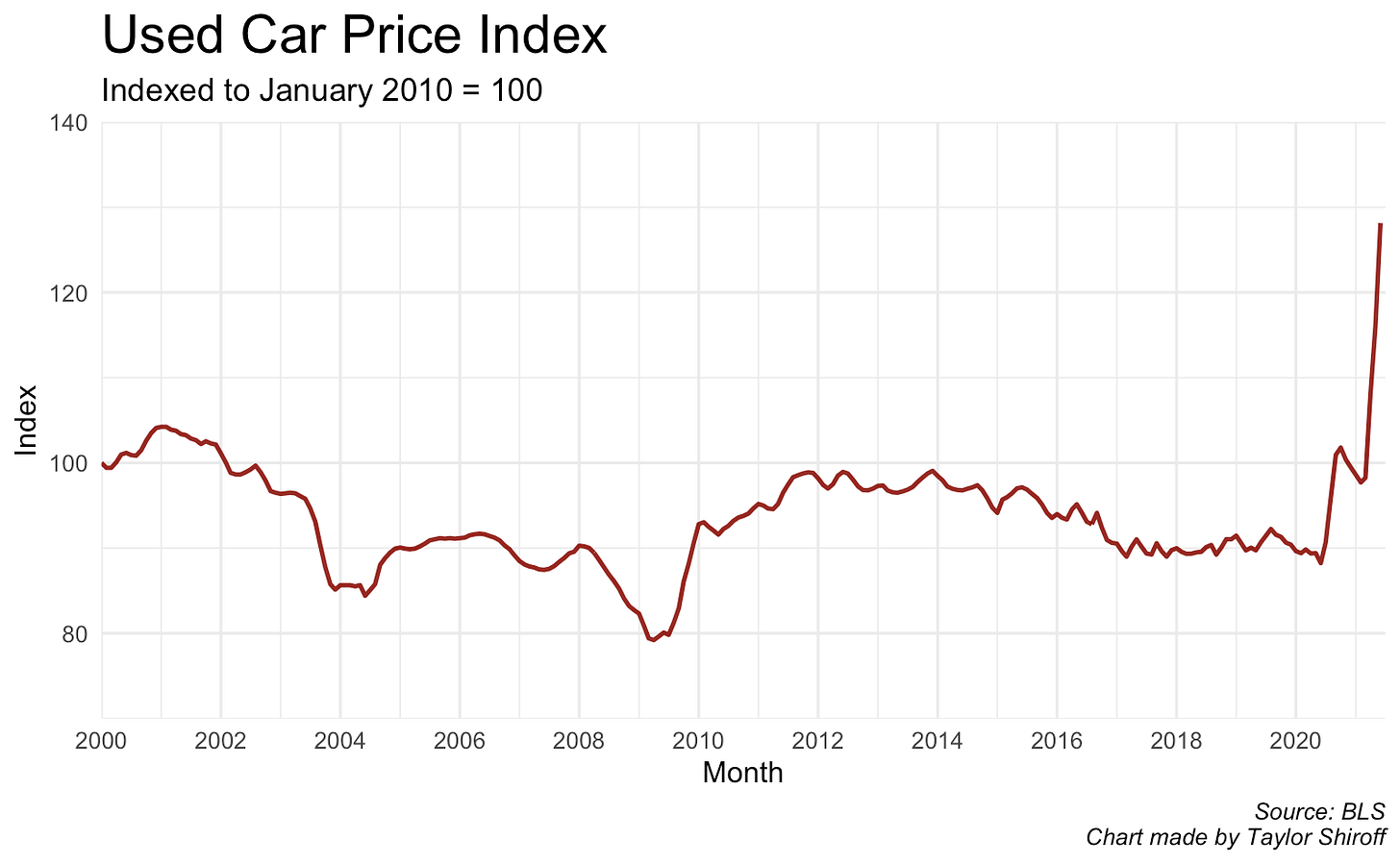

Soaring used car prices have been the subject of comedy and worry for the last several CPI releases now. It’s easy to see why:

I’ve written before about the usefulness of trimmed-mean and median price indices for cutting out noise that doesn’t say that much about the economy as a whole. Does 2021’s near-vertical line in the used car price index really say that much about where things are going?

Another Way Cars Cause Problems

I’ll look at new and used car prices and throw in hotel rooms (technically “other lodging away from home including hotels and motels”) and airfare as well. If we take these out of the CPI since January, monthly inflation is cut by about a quarter.

I could’ve added more transitory factors, but these four alone say enough. We still do not need to worry about inflation spiraling out of control. Team transitory still looks quite correct, just a little bit hotter than predicted. Expectations from those who matter are still grounded at healthy levels (see Joey’s great article about this). I’ll leave off with the chart above expanded back to January 2020. Does this really look so scary? We’ve got maximum employment to reach — there’s no time for causing a recession to fight rising car and vacation prices.